There are many reasons for people, who previously had good credit, to switch to poor credit. Most times it is beyond their control. For example, if you lose your job, that can lead to bad credit. When despite your best efforts you have not gotten a new job, this can lead to missed payments, on your bills. When you miss payments on your bills—well, you start down that slippery slope to ruined credit and possibly bankruptcy. To read more about the causes of a bad credit rating, visit this website: https://dailipay.net/

However, there is hope on the horizon.

The Business Of Helping Credit Challenged People

For normally responsible people suddenly facing the inability to pay their bills is disheartening. When you have worked years carefully building your credit, having it fall to the wayside can be frustrated. Instead of throwing things or drowning your sorrows in alcohol, contact a reputable credit repair firm. They are likely to mention three simple methods to clear up your credit woes. To discover more about the most trustworthy credit reporting agency, visit this website: https://www.ins78.com/

Check Your Credit Report

Initially you will be advised to order a tri-merge credit report. This essentially is all three credit bureaus: Experian, Transunion, and Equifax. Each one will report a different FICO (Fair, Isaac and Company) score. When you attempt to get a loan of any type, the Mid, or middle score will be the one you are judged on. Your report should be reviewed annually, to see if any errors are listed. Sometimes late payments are posted incorrectly or the amounts owed are inaccurate. If you find this to be the case, you must contact the credit bureau with a dispute letter, replacing it with accurate numbers.

Setup Reminders For Your Various Payments

In this busy world we live in, you might just overlook a payment or two, from time to time. Even when you have the money to pay it, being human in the financial world is seldom given a pass. Whether computerized or manually, keep a spreadsheet of what payments are due monthly and in what amount. Since this is one of the biggest factors that contribute to your score, always make your credit payments on time. Some utility companies have started reporting late payments, to the credit bureaus; so don’t think just credit card companies are reporting. Being late on your electric and water bill is also a no-no. Automatic bill payments from your checking account can go a long way toward better money management.

Reduction In Your Amount Of Debt Owed

It may seem logical, but working to reduce your overall debt owed to creditors can also help fix your bad credit problem. If you can put yourself on a self-inflicted moratorium on using the credit cards for a period of time, it will help. When you get a tax refund, instead of buying something, put it towards bringing down your debt. Try a system of paying down extra on your highest interest cards first, while maintaining the minimum payments on the low interest cards.

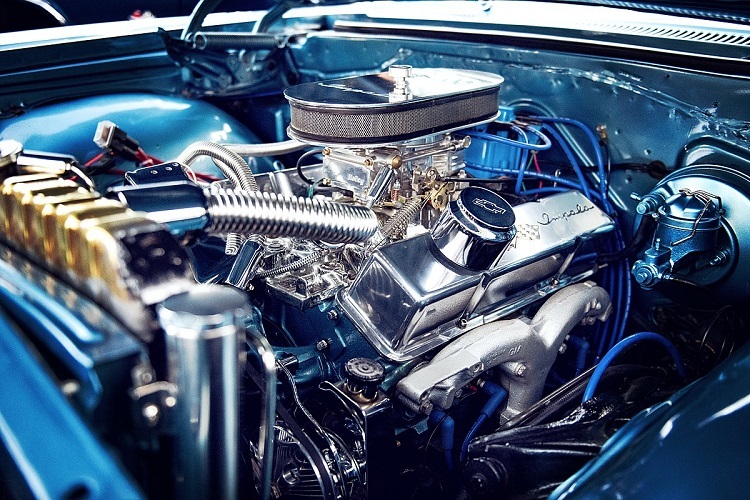

The road leading to the Good Credit Lane is a long and arduous one. It will have bumpy spots and maybe even some potholes. But, in the long-term, it is worth it to implement good sound techniques, that will slowly raise your credit score. Once you do that all roads will open toward good interest rates and prosperous times ahead.

To get simple solutions or strategies to improve bad credit visit this website: https://news-takeuchi.com/